Web3 Business Models - Crypto Payment Services and Financial Inclusion

As technology advances exponentially and makes the life of an increasing share of the global population easier, digital inclusion has been on the rise. However, an area that still lacks inclusion is finance. Cryptocurrencies have been making headlines in recent years as an innovative and disruptive technology with the potential to revolutionize many aspects of our lives, including how we pay for goods and services and transact with one another. With the rise of digital assets like Bitcoin, Ethereum, and others, a new wave of businesses has emerged, offering crypto payment solutions to merchants and consumers alike. - Author: Elias Mendel

|

Table of Contents |

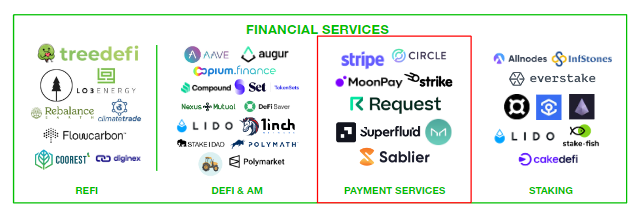

Crypto payment services breakdown

Crypto payment services strive to bridge the gap between our fiat currency system and cryptocurrency payments. They usually aspire to offer an alternative to the current payment services by offering a cheaper, faster, or more accessible solution, or enabling merchants to offer payments using crypto. Their realm spans remittance, B2C & B2B payments (payment gateways), e-commerce plugins, fiat on- and off-ramping, and stablecoins. Accordingly, they play an important role in financial inclusion.

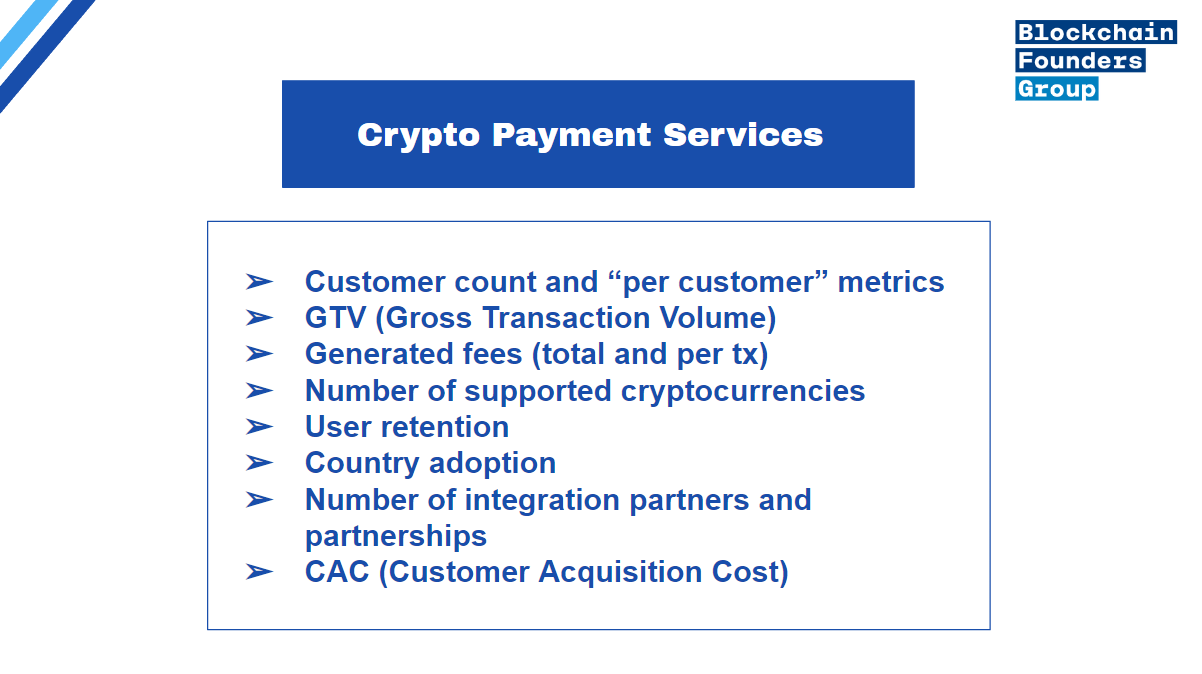

Alluding to our previously published Web3 business model guide, we want to elaborate on some key metrics worth considering when looking at bespoke crypto payment service providers. It needs to be said that not all metrics apply to every service.

One of the primary metrics to track is the number of customers using the service, as this provides insight into the size and growth of the user base. Of course, having a range of “per user” metrics available helps as well (e.g., the number and volume of monthly payments by customer). The gross transaction value (GTV) is also an important metric, as it reflects the total payment volume transacted through the platform. In addition, revenue in the form of fees charged for transactions (often a percentage), is a critical metric for evaluating the financial health of the business. In addition to financial metrics, there are other metrics that businesses in the Web3 space should track. For example, the number of cryptocurrencies accepted can attract a wider range of users and increase transaction volume. Furthermore, user retention is crucial for securing a sustainable user base over the long run. By tracking user retention rates, businesses can identify areas where they can improve the user experience and implement strategies to keep users engaged and satisfied.

Expanding the reach of the business by considering the number of countries where the solution is accepted and regulated and the number of integration partners can also have a significant impact. By working with more wallet providers or fiat on-ramp providers, for example, businesses can increase the ease of use and convenience of the platform, making it more attractive to potential users. Finally, customer acquisition cost (CAC) is a critical metric that measures how much it costs to acquire each new customer, providing insight into the effectiveness of the company's marketing and customer acquisition strategies. By tracking these KPIs, businesses in the Web3 space can gain valuable insights into their performance, identify areas for improvement, and make data-driven decisions to help grow their business.

Figure 1: A wrap-up of some crucial metrics for crypto payment services.

Blockchain increasing financial inclusion

Below we will list a couple of specific examples of how cryptocurrencies and blockchain technology can be used to facilitate payments. By using Bitcoin & Co., individuals who are unbanked or facing financial difficulties due to weak currencies with high inflation rates, particularly in regions such as Africa and Latin America, can gain access to financial services. We would like to clarify that none of the projects mentioned are endorsed or sponsored by our organization in any capacity. The intention behind presenting these projects is to showcase some noteworthy use cases that may be of interest to our audience.

Bitcoin (BTC) can also be used for cross-border payments, and many remittance companies have started to accept Bitcoin as a form of payment. For example, BitPesa is a remittance company that allows people in Kenya, Uganda, Tanzania, Nigeria, and other African countries to send and receive money using Bitcoin. BitPesa's platform enables fast and low-cost cross-border payments, which can be especially useful for people who need to support their families in different countries.

Strike is a payments app that uses Bitcoin Lightning to enable fast, low-cost cross-border payments. Users enter the amount they want to send, which is converted into Bitcoin and sent via the Lightning Network to the recipient, who can then convert it into their local currency and deposit it into their bank account. Because Strike uses the Lightning Network, the transaction is fast, cheap, and secure. Transactions can be completed in seconds, and fees are minimal compared to traditional cross-border payment methods. This makes it an attractive option for people who need to send money across borders fast, especially in countries where traditional banking services are limited or expensive.

Paxful is a peer-to-peer cryptocurrency marketplace that enables users to buy and sell Bitcoin and other cryptocurrencies with over 300 payment methods, including cash deposits, online transfers, and gift cards. Paxful has a strong focus on financial inclusion and aims to empower the unbanked population by providing a simple and accessible way to buy and sell cryptocurrencies. The platform has gained popularity in emerging markets such as Africa, where traditional banking services are often unavailable or expensive. Paxful also offers a range of educational resources and community support programs to help users learn about cryptocurrencies and access the benefits of blockchain technology.

Request Network is an open-source platform that enables individuals and businesses to send and receive payments in a variety of currencies, including cryptocurrencies, fiat currencies, and other digital assets. The platform is designed to be low-cost, fast, and easy to use, with a focus on streamlining global transactions and promoting financial inclusion. Request Network uses its native cryptocurrency called "REQ" as the medium of exchange for transactions on its network and offers built-in exchange functionality to allow for easy conversion between currencies. One of its key features is its support for "cross-currency" transactions, which allows users to send and receive payments in any currency they choose, without the need for costly currency conversions.

meCash: Building cross-border payment infrastructure for African SMEs

SMEs are the economy’s backbone

Small and medium-sized enterprises (SMEs) are the backbone of economies worldwide, responsible for the majority of formal employment and the creation of new jobs. SMEs make up over 90% of firms and more than half of the formal employment sector worldwide. In developing countries, SMEs employ more than 60% of the formal workforce. Despite their importance, SME financing in low- and middle-income countries is significantly lower than what would be expected in a competitive capital market, with a shortfall of USD 2.1-2.6 trillion, or 30-36% of outstanding SME credits1. This funding gap highlights the need for increased support for SMEs to ensure their continued growth and success. In Sub-Saharan Africa, for example, over 44 million formal MSMEs face a credit constraint, leading to a financing gap of $328 billion, excluding potential demand from informal MSMEs of an additional $312 billion. Traditional banks have strict collateral requirements and credit checks that make it difficult to meet the financing needs of MSMEs. Fintechs and digital banks have an opportunity to serve this underserved market segment by leveraging technology to facilitate cross-border payments and lend unsecured capital profitably even in remote areas. The MSME space in Sub-Saharan Africa has significant potential for growth if costs can be controlled and services made accessible.

Making remittance payments more affordable

Then there’s also the issue with remittance payments. According to the World Bank, Sub-Saharan Africa is the most expensive region in the world to transfer money to from abroad, with sending $200 costing an average of 8.2% of the total transfer in Q4 2020. This is significantly higher than the fees in other developing regions, such as Latin America and the Caribbean (5.6%) and South Asia (4.9%). This high cost of remittances is a barrier for many Africans who rely on remittances for their livelihoods. For example, sending money from South Africa to Botswana can cost up to 19.6%, which is an exorbitant amount for many people. Another challenge is the lack of formal channels for remittances. Many Africans still rely on informal channels, such as friends and family members who are traveling between countries, to send money2.

Fintechs and digital banks have an opportunity to fill this gap by leveraging technology to facilitate cross-border payments and lend unsecured capital profitably even in remote areas. The MSME space in Sub-Saharan Africa has significant potential for growth if costs can be controlled and services made accessible. Enter meCash.

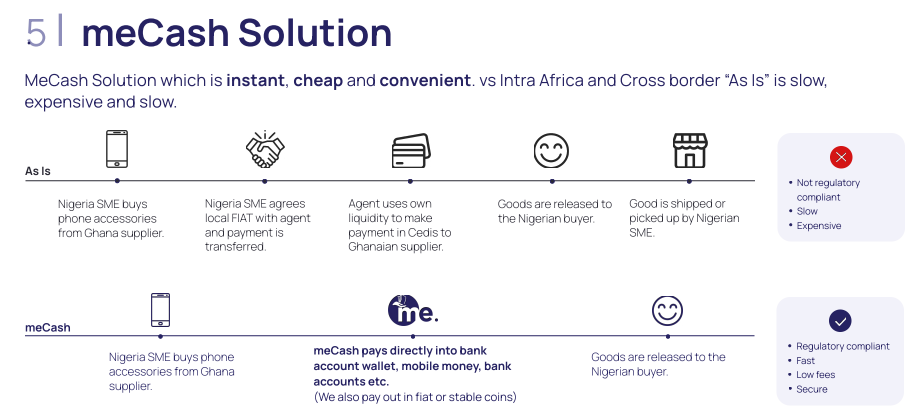

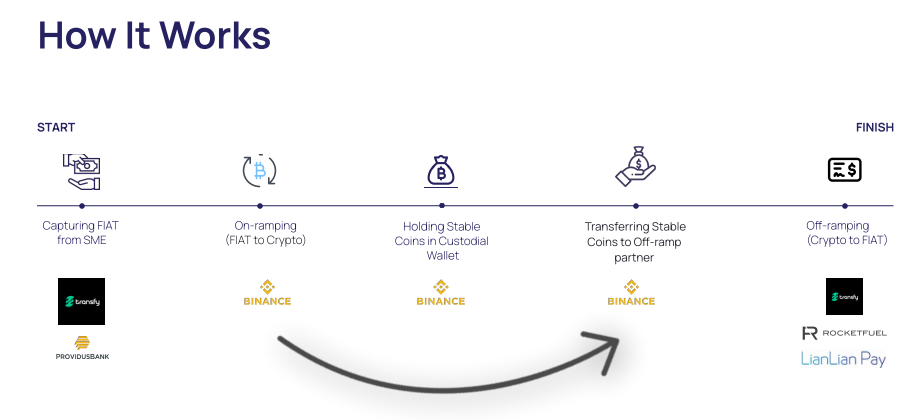

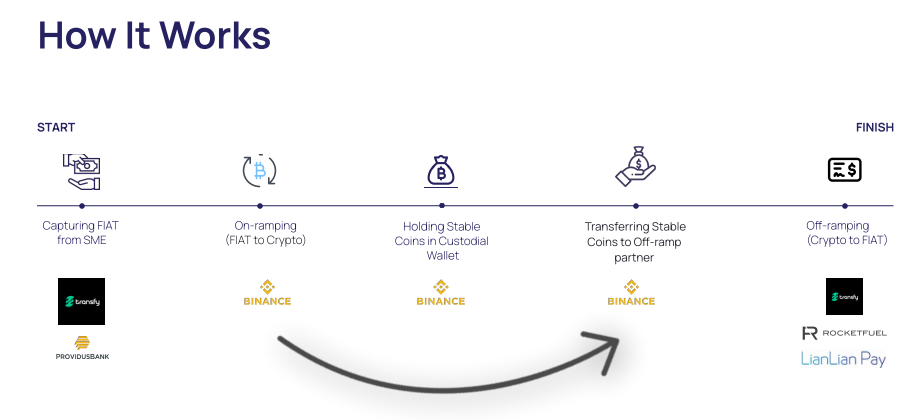

meCash is enabling SMEs in Africa to send and receive cross-border payments for goods and services using blockchain technology and stablecoins. By utilizing stablecoins, meCash allows for on- and offramp of fiat to crypto while offering real-time settlements. meCash bridges the gap between buyers and sellers and settles transactions in either fiat currency or stablecoins directly to users’ bank accounts, mobile, or web3 wallets. Handling both crypto on- and off-ramping as well as the transfer of funds, meCash covers the entire end-to-end, cross-border payment value chain, creating a convenient and seamless UX.

Figure 2: A breakdown of how meCash intends to facilitate Intra-African cross-border payments.

Figure 3: An overview of how meCash and its partners streamline the crypto on- and off-ramping process.

Figure 4: meCash’s main product features.

Some closing thoughts

Crypto payment services are transforming the way we transact by providing a fast, secure, and cost-effective alternative to traditional payment methods. They are also playing a critical role in the mainstream adoption of Bitcoin & Co. by integrating them into our everyday lives. Additionally, these services are helping to provide access to financial services for the unbanked and financially underserved populations. By leveraging the advantages of cryptocurrencies such as low transaction fees, fast settlement times, and global reach, crypto payment services are enabling these individuals to participate in the global economy and contribute their share in creating a more level playing field. meCash is an example of a crypto payment service that is facilitating cross-border payments for African SMEs, helping to unlock the potential of Intra-African trade and create a more connected and inclusive world. Overall, crypto payment services are a crucial component of the evolving financial ecosystem, paving the way for a more accessible, secure, and efficient future of payments.

References

1. https://www.idos-research.de/uploads/media/DP_4.2020.pdf

2. https://fincog.nl/blog/38/sme-banking-remittances-in-africa

About Blockchain Founders Group

Blockchain Founders Group (BFG) is the driving force behind web3 innovation. As a company builder, we bring together a team of blockchain visionaries, experienced entrepreneurs, and industry experts, all committed to nurturing emerging talent. Our BFG acceleration programs serve as your springboard for launching blockchain startups, transforming concepts into reality in just 2-3 months. Each cohort develops 5-8 unique web3 ideas, and selected projects will be financially supported with 70,000 - 100,000 EUR, along with access to our extensive network. Join us in shaping the future of web3!

Stay updated by connecting with us on LinkedIn, Medium, Twitter, and YouTube.

Contact: Max Zheng, Director of Investments, max.zheng@blockchain-founders.io

Subscribe by email

Share this

You May Also Like

These Related Stories

Becoming an entrepreneur and launching your crypto startup

Web3 Business Models - An Insight into the Metaverse & GameFi

Comments (1)