Web3 Business Models - An Insight into the Metaverse & GameFi

In one of our past articles, we provided a condensed overview of various Web3 business models, their KPIs as well as respective protocols and businesses. Equipped with this knowledge, we now want to dive deeper into specific niches and provide some real-life examples. As such, today, we will be taking a closer look at “Web3 Entertainment”, and more specifically, the GameFi & Metaverse niche. - Author: Elias Mendel

|

Table of Contents |

|

1. How the Metaverse gained traction |

How the Metaverse gained traction

Since Mark Zuckerberg announced Facebook's rebranding to Meta Platforms, the Metaverse has been in the spotlight. Despite Zuckerberg's polarizing reputation, it is largely due to his decision that the Metaverse gained massive public attention during the last crypto bull run. However, as we all know, Meta has faced numerous scandals and controversies in the past, and it remains questionable whether one of the largest profit-driven corporations in the world should be the central entity in a virtual realm that prioritizes user rights and ownership.

Accordingly, in late 2021, Web3-based Metaverse initiatives, specifically Decentraland and The Sandbox, were at the epicenter of a discourse surrounding the interconnected, experiential "people's Metaverse," operated by a community and governed by code. The degree of decentralization in these projects and the level of influence wielded by their backers is a subject of debate that surpasses the scope of this piece. Despite bespoke queries, propelled by speculators, the projects' values were soaring, and great expectations were set. However, a year later, the user base has drastically declined, and the same can be stated regarding token prices, emblematic of the current pessimistic attitude. Hence, one might inquire, what transpired to cause this decline, and how’s the sentiment behind the scenes.

In hindsight, the Web3 Metaverse hype was driven by extreme market euphoria but lacked sustainability. There are multiple reasons for these developments.

Firstly, many Metaverse and GameFi rely too heavily on their respective project token price performance. When the token price started dropping significantly, many users playing Web3 games due to monetary reasons were increasingly discouraged to continue playing the game. This, in turn, lead to even starker price drops, and hence, some sort of vicious cycle. Hand in hand with this goes the fact that many projects have rather poor graphics, and the scope of activities is rather limited. So with monetary motivations dwindling, and media attention fading, it becomes growingly difficult to attract new users and retain existing ones.

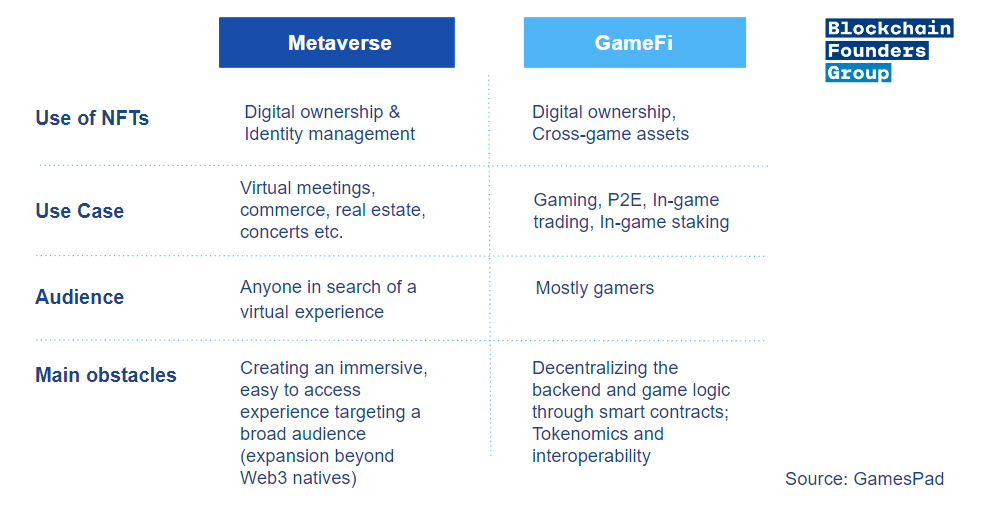

Figure 1: Take a look at this comparison between the Metaverse and GameFi, inspired by GamesPad. Note, however, that the two often overlap and we have made some simplifications for this overview’s sake.

Fully decentralized Web3 entertainment

One of the next steps in the evolution of GameFi and the Metaverse is to take the decentralization a step further. At the current stage, some in-game assets are stored on-chain, yet, the game’s logic is not. Instead, everything is handled off-chain, and traditional gaming engines like Unity or Unreal are utilized. While this certainly comes with many perks, such as a richness of features, and the applicability of common game development practices, it contradicts Web3 ethos of full decentralization.

Blockchain-based games vary in their use of on-chain features, ranging from only nominal game assets stored on-chain to the entirety of game assets and the full game state stored on-chain, which are called Fully On-Chain (FOC) games. FOC games have on-chain game logic and a fully shared state, enabling anyone to customize them through user-generated logic (UGL). However, FOC games have significant trade-offs, such as degraded user experience due to slow latencies of syncing with the chain and limiting the style of games to turn-based or asynchronous world-building games like Minecraft. Creating massive multiplayer online (MMO) games like Fortnite is comparatively difficult.

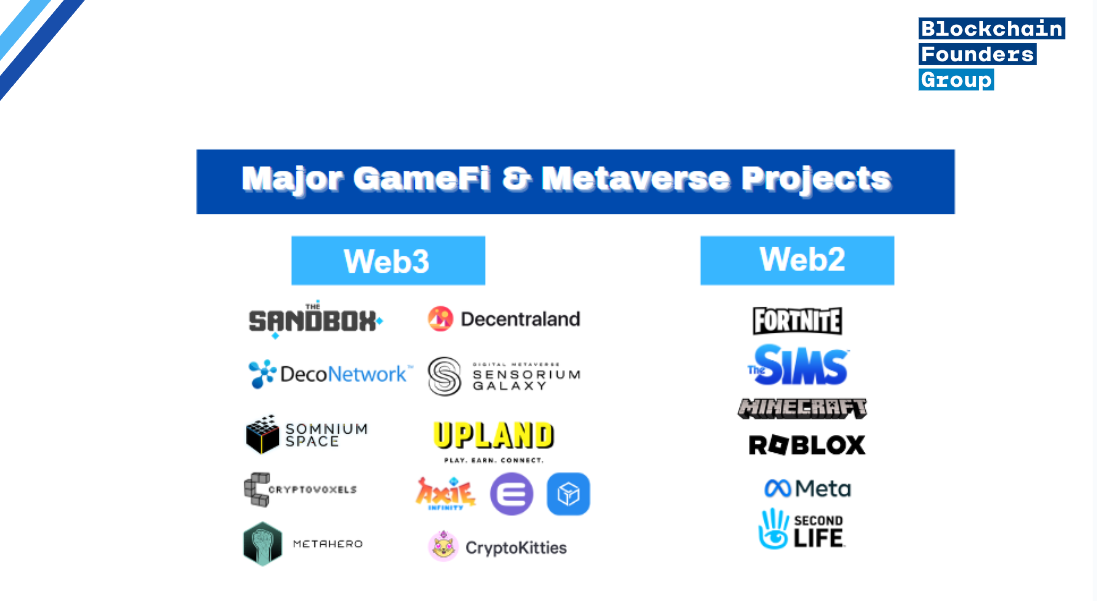

Figure 2: A comparison of some major Web2 and Web3 projects in the GameFi & Metaverse realm.

As such, at the current stage, it’s hard to imagine a fully decentralized game capable of competing with traditional games in terms of graphics, UX, and overall game speed, not even to mention the implementation of immersive, VR experiences. Therefore, current Web3 Metaverse and GameFi projects do pose a transitory phase between traditional, centralized, and decentralized gaming, a necessary step to onboard the next wave of users. In the long run, however, with blockchain throughput and scalably steadily on the rise, we might begin to see increased “on-chaining” of gaming experiences.

Measuring the health of GameFi & Metaverse projects

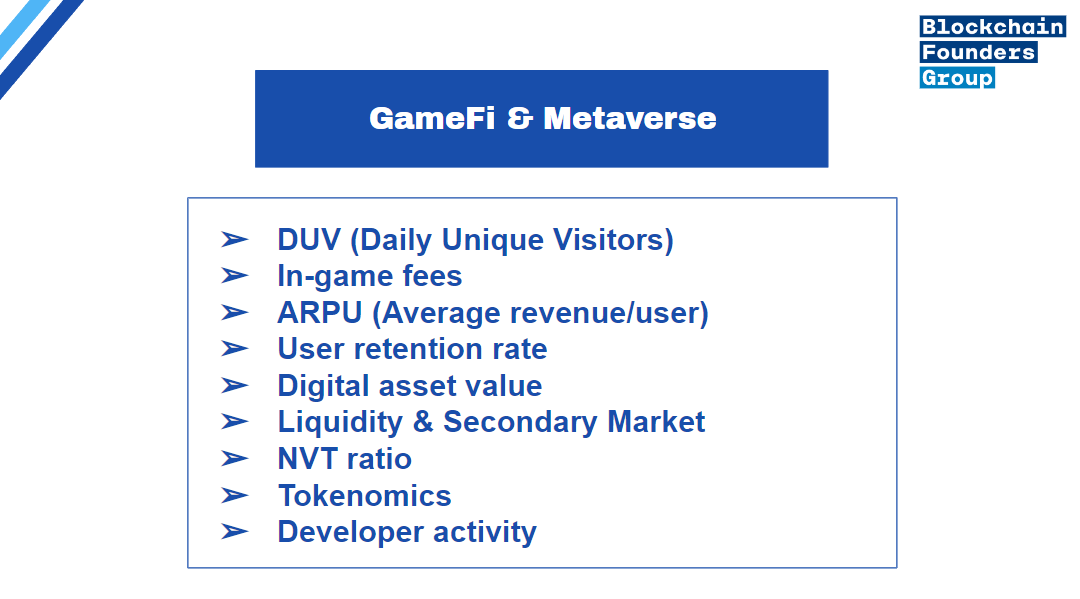

Figure 3: A brief overview of some key criteria for GameFi & Metaverse projects.

There are a couple of metrics that can help in assessing a project’s health. Note, however, that the metrics might not be suitable for every project to an equal extent.

The most important metrics include daily unique visitors (DUV), the DUV growth rate, fees on in-game purchases, and the value of digital assets within the game or Metaverse.

Let's start with DUV, daily unique visitors, which measures the number of active community members who engage with the game or Metaverse platform daily. DUV growth rate, measured weekly or monthly, indicates how quickly the respective community is growing, a key factor in long-term success. In-game purchase fees, ranging from a few cents to several dollars, can generate significant revenue, particularly for mobile games. Dividing the sum of monthly/daily in-game purchases by the number of unique players in the same time frame gives a good proxy for the ARPU - the average revenue per user.

Closely tied to this is the user retention rate, i.e. the number of users that regularly return to play the game or spend time in the Metaverse. Similarly, one should consider the average time spent by the users. Can they remain entertained for hours and hours, or do they usually leave the game/Metaverse after a short while? This number can be particularly useful for developers, as it can provide them with essential clues on whether there’s a high urgency for expanding the in-game activities.

The value of digital assets, like virtual real estate or rare weapons, is another crucial metric as they can be worth thousands or even millions of dollars and generate substantial revenue, and reflect user demand over time. However, to gauge user activity, it is also prudent to have a look at secondary market activity. That is, how easy is it for users to resell their in-game assets? That way, crucial insights into a project’s overall in-game liquidity and demand can be gained.

When trying to assess a project’s token utility and “valuation”, one can have a look at the NVT ratio. NVT stands for Network Value to Transactions ratio, and it is calculated by dividing the market capitalization of a cryptocurrency by the daily transaction volume on its blockchain. The NVT ratio provides an estimate of how much value is being transacted on a cryptocurrency network relative to its overall market value. For example, Decentraland, for mid to end March, had an NVT ratio of around 79, whereas The Sandbox had an NVT ratio of around 42, suggesting that SAND is more cheaply valued per unit of tx volume.

The NVT’s reciprocal value is the token velocity. It is calculated by dividing the total transaction volume of the token over a specific period by the average market cap of the token during that same period. Token velocity helps to measure the frequency at which tokens are changing hands within the ecosystem. With token velocity, there is essentially a range that is most conducive to strong tokenomics. If the token velocity is too low, there’s a lack of transaction volume in the network, and as such, the token price collapses. If the token velocity is too high, there’s no incentive to hold onto the token, implying it has no inherent value other than enabling transactions (imagine a highly inflationary fiat currency that is spent immediately upon receival by every person; it would have a high velocity, but no real value).

And lastly, of course, a project’s development activity (check GitHub) needs to be taken into account, as this poses a project’s backbone.

%20%5B00.22.08%2c%2004%20May%2c%202023%5D.png?width=3840&height=1300&name=Decentraland%20(MANA)%20%5B00.22.08%2c%2004%20May%2c%202023%5D.png)

Figure 4: Decentraland’s price, development activity, and daily unique addresses, showing quite some fluctuations. Positive to note is the project’s steadily ongoing development activity, despite bearish price developments. Notice the correlation between daily active users and the price. Source: Santiment

%20%5B00.24.23%2c%2004%20May%2c%202023%5D.png?width=3840&height=1300&name=Decentraland%20(MANA)%20%5B00.24.23%2c%2004%20May%2c%202023%5D.png)

Figure 5: The Sandbox’s price, development activity, and daily unique addresses, showing quite some fluctuations. Notice the correlation between daily active users and the price. Source: Santiment

Introducing Signa X

To give you a more specific example, let’s talk about Signa X, a start-up we incubated and invested in in 2022. Currently, there are multiple issues many Metaverse and GameFi projects are currently facing.

First of all, from a supply-side perspective, it can be challenging for projects to generate digital assets in large quantities because of the constraints imposed by team size and technological resources. Additionally, the cost of purchasing in-game assets can be high for users because of the limited production and supply, leading to a high entry barrier. Prices are so high because most Metaverse and GameFi studios work closely with gaming studios, which entails fairly high costs for digital assets. That is, many digital in-game assets lack affordability and usability. In order to further caption user interest and time, Metaverse experiences need to be increasingly immersive - in-game 3D assets can be the stepping stone for the Metaverse in achieving this mission.

UK-based Signa X is tackling these bottlenecks. Signa X's platform is designed to address the key challenges of high production costs and underutilization of assets in the Metaverse. By pooling and collaborating with verified creators, Signa X creates unique digital assets in large quantities, enabling projects in the Metaverse and GameFi to launch and thrive. Also, Signa X's leasing platform allows users to monetize their idle digital assets by leasing them out for different projects, thus bridging the gap between supply and demand while generating revenue for asset owners. Its latest feature, the release of an AI asset generator, allows users to generate in-game assets purely by briefly describing them.

Conclusion

In conclusion, the hype around Web3-based Metaverse projects was driven by extreme market euphoria and monetary incentives but ultimately lacked sustainability. Many projects relied too heavily on their respective token prices. However, Web3 Metaverse projects are undergoing a necessary transitional phase between traditional, centralized, and fully decentralized gaming, with the latter being the long-term goal. At the current stage, fully decentralized games are not capable of competing with traditional games in terms of graphics, UX, and overall game speed.

Metrics such as daily unique visitors (DUV), fees on in-game purchases, the user retention rate, developer activity, and the value of digital assets are crucial for measuring the health of GameFi and Metaverse projects. It is important to note that these metrics may not be suitable for every project to an equal extent.

Looking forward, the success of Web3 Metaverse projects will depend on how well they can balance decentralization, user rights, and ownership with profit-driven goals. Additionally, the evolution of blockchain technology, including improved throughput and scalability, will be necessary to enable fully decentralized gaming experiences that can compete with traditional games.

About Blockchain Founders Group

Blockchain Founders Group (BFG) is the driving force behind web3 innovation. As a company builder, we bring together a team of blockchain visionaries, experienced entrepreneurs, and industry experts, all committed to nurturing emerging talent. Our BFG acceleration programs serve as your springboard for launching blockchain startups, transforming concepts into reality in just 2-3 months. Each cohort develops 5-8 unique web3 ideas, and selected projects will be financially supported with 70,000 - 100,000 EUR, along with access to our extensive network. Join us in shaping the future of web3!

Stay updated by connecting with us on LinkedIn, Medium, Twitter, and YouTube.

Contact: Max Zheng, Director of Investments, max.zheng@blockchain-founders.io

Subscribe by email

Share this

You May Also Like

These Related Stories

The Predominant Web3 Business Models And Their Key Metrics

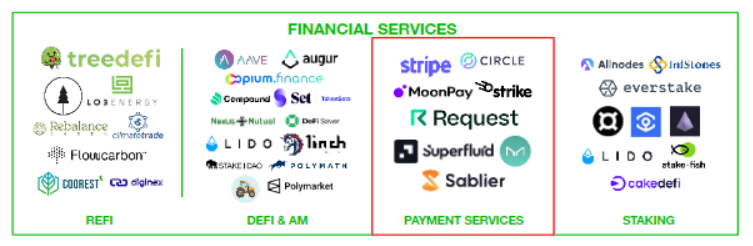

Web3 Business Models - Crypto Payment Services and Financial Inclusion

No Comments Yet

Let us know what you think