Insights on the Current State of Web3: Hot Narratives Shaping Web3 in 2023

This article picks up on some topics addressed in a16z’s recently published “2023 State of Crypto” report and provides an assessment of some of the latest developments, such as Web3 centralization, the modular blockchain approach, and Ethereum restaking. - Author: Elias Mendel

Web3 Centralization: How does Web3 counterbalance the trend toward internet consolidation?

While the ethos and long-term goal of Web3 is to exist in a state of complete decentralization, secured by a scattered network of nodes and validators or miners, at its current stage, there are still some centralization issues worth further elaborating on. Partially, these are the result of the technology not having matured enough (e.g., centralized rollup sequencing), while other centralization issues seem to stem from convenience and lock-in effects.

a. Many nodes use centralized servers

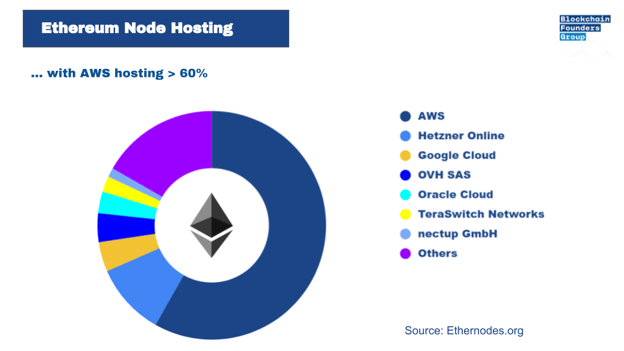

More than 2/3 of Ethereum nodes rely on centralized servers, with the major ones being AWS (65%), Hetzner (11%), Google Cloud (3.9%), and OVH SAS (4.5%)1. This is majorly due to the ease and low cost of setting up a node through a centralized cloud hosting service compared to setting up one’s own node infrastructure.

Likewise, similar issues are apparent in the Solana network, with the same providers serving more than 70% of nodes (AWS: 3%, Hetzner: 42% & OVH: 26%), as of August last year2.

Figure 1: Ethereum nodes relying heavily on AWS, Hetzner Online, and Google Cloud. Source: Ethernodes.org

b. Very few Ethereum staking pools dominate

With regards to Ethereum staking, few players dominate the market. The largest control is exerted by Lido Staking, which currently holds about 32% of the total staked Ether. This is a concerning figure since it takes 51% of staked Ether to attack the network. However, it needs to be noted that Lido itself is a DAO with thousands of members, and is working on improving its decentralization. Coinbase and Binance are next (10.8% and 5.5%) regarding staking shares. Concerning liquid staking, the centralization issue appears even more dire. Ever since the Shangai update in April this year, enabling staking withdrawals on the Beacon chain, liquid staking pools have seen significant inflows. Lido alone has seen about $200 million in ETH deposit inflows in early May, giving it a quasi-monopoly of currently more than 86% market share in liquid staking. One mitigation attempting to tackle the centralized nature of ETH stalking is called “Distributed Validator Technology (DVT)”, which strives to provide the technological means for small groups of stakers to seamlessly stake their ETH and act as a single validator, making staking more accessible. Ideally, this will prompt an increasing share of ETH stakers to leave dominant staking pools and other centralized staking services, thus improving the network’s decentralization and censorship resistance. Read more on DVT here.

c. Bitcoin mining is heavily dominated by a few mining pools

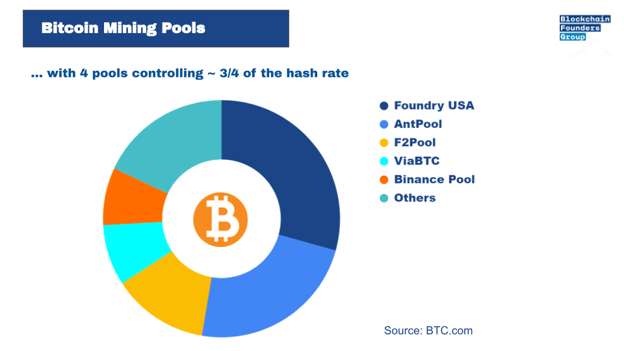

Figure 1: Few Bitcoin mining pools control the majority of Bitcoin’s hash rate. Source: BTC.com

Likewise, 4 mining pools, namely Foundry USA, AntPool, Binance Pool, and F2Pool account for approximately 75% of Bitcoin’s hash rate, and Foundry USA & AntPool, resources combined, could theoretically execute a 51% attack. However, it is worth noting that from a game-theoretical perspective and in the long run, it makes more sense for mining pools to pursue legitimate mining, earning the normal mining rewards, instead of maliciously tampering with the blockchain through double spending or transaction blocking, as this would inevitably weaken Bitcoin and this potential mining rewards looking forward.

d. MEV-boosting relayers dominate Ethereum’s block proposition

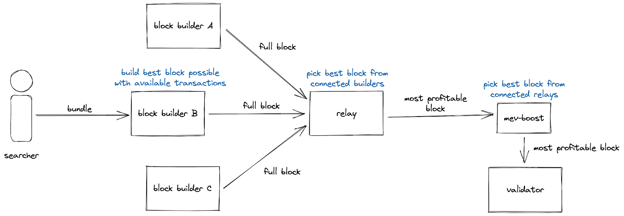

Very few relayers, namely Flashbots, BloXroute Max Profit, Ultra Sound Relay, and Agnostic Relay, account for the largest share of relayed blocks. At the time of writing, about 30% of blocks are created using MEV-boost relays. Relayers mediate between block builders and validators, effectively helping validators outsource the block-building process, and extracting the maximum value (i.e. maximum tx fees) possible. Relaying is based on the proposer-builder-separation (PBS), and validators running MEV-boost relayers maximize their staking reward by selling blockspace to builders in an open market. This is supposed to protect users from suffering under the likes of sandwich attacks or frontrunning.

In particular, Flashbot stands out, relaying about 30% of all MEV-boost blocks. This centralization could turn out to be problematic concerning censorship resistance, as was visible last year when OFAC sanctions against Tornado Cash led to 75% of blocks being censored at that time. However, (luckily, for the sake of censorship resistance), this number has come down significantly, with 32% of blocks being OFAC compliant at the time of this writing.

Figure 3: An overview of how Flashbots implements the PBS. Note that the tx sent by the searcher is not public, i.e. not Ethereum’s mempool, to prevent malicious actors from frontrunning, sandwich-attacking, etc. Source: Flashbots

e. Rollups use highly centralized sequencers

Rollups are being hailed as the solution to Ethereum’s scaling bottlenecks, and rightfully have their spot in the ecosystem’s long-term modular vision, enabling instant transactions and incredibly high throughput. Yet, most rollups, in their current stage, rely on an in-house single sequencer model3. Without diving deep into the technicalities, and the differences between ZK and optimistic rollups, a sequencer is an entity responsible for aggregating, verifying, and submitting the transaction data back to L1. A single sequencer is controlled by one entity, which contradicts the ethos of decentralization.

A sequencer under the umbrella of an entity might be more likely to be legally (e.g. OFAC) compliant, thus reducing censorship resistance. Likewise, there is nothing stopping sequencers from capturing MEV at the expense of the users, ignoring user transactions, or worse.

While there are plans to decentralize and defragment sequencing, such as Justin Drake’s proposal for base sequencing or shared sequencing, it is still a long way to go, and until we get there, sequencer centralization remains something to be wary of. However, as alluded to in the intro, with rollups being a very novice technology, it is to be expected for the scaling solution to take some time to fully decentralize. Have a look here to find out more about the risks associated with various layer 2 scaling solutions.

f. Many predominant stablecoins are centrally controlled

Another factor to bear in mind is the high degree of centralization of some of the most adopted stablecoins like USDC or UDST. Both are backed by one entity (USDC by Circle and USDT by iFinex), which puts them at the will of regulators, or, equally problematic, at the will of the bank holding the stablecoin-backing reserves. Recall how USDC dropped sharply after it had been disclosed that SVB held more than $3 billion in Circle’s cash reserves.

Collaboration instead of competition: The modular blockchain approach is gaining traction

The predominant blockchain architecture currently is monolithic. That is, all activity is centered around one blockchain. That means that a blockchain’s core components - execution and consensus & data availability are all happening in the same ecosystem. As a result, firstly, monolithic blockchains face specific bottlenecks since core functions are all enforced by the same set of validators, and transactions are likewise executed by the same validators. Secondly, blockchains have become more competitive than collaborative.

To make an analogy - imagine the current framework of blockchains to be more akin to the way cars were manufactured before Henry Ford introduced the moving assembly line, which was centered around the separation of tasks in a logical order, forever revolutionizing the way cars were built. The same applies to blockchains. Instead of tasking the same set of nodes and validators with all of the core duties, why not split up the workload and boost overall efficiency? While have indeed seen progress, e.g. the advancement of rollups (execution) and sharding (subdividing all core function to different shards, i.e., “sub-blockchains”), or blockchains like Solana “outsourcing” data availability to Arweave, there is still a lot of work to be done. A project addressing this issue is Celestia.

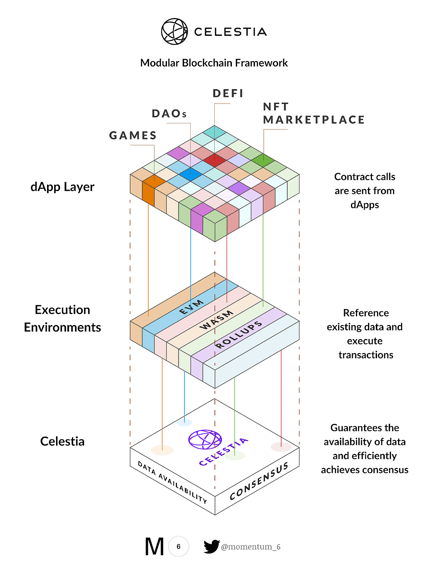

Celestia aspires to provide a modular blockchain architecture framework, splitting the workload between execution and consensus & data availability4. Instead of projects having to build their blockchain from scratch, or having to rely on a monolithic blockchain to fulfill all of these functions, they can “outsource” certain functions to Celestia while still using other blockchains for the remaining functions. For example, Ethereum Layer2 rollups can execute transactions and send the data to Celestia’s Layer1 (which supports all sorts of rollup execution environments, such as EVM, Solana VM, or Fuel VM rollups). Once the data has been included in blocks on the Celestia blockchain, the data will be relayed in the form of a data availability attestation to the Ethereum mainchain5. Thus, while settlement and execution happen through Ethereum, data availability is done using Celestia, without compromising in security as attestations are used to confirm the txs’ validity.

Figure 4: A good breakdown of Celestia’s modular framework. Source: Momentum6

Staking helps transform collateral into outsized economic security: Restaking ETH to introduce SaaS

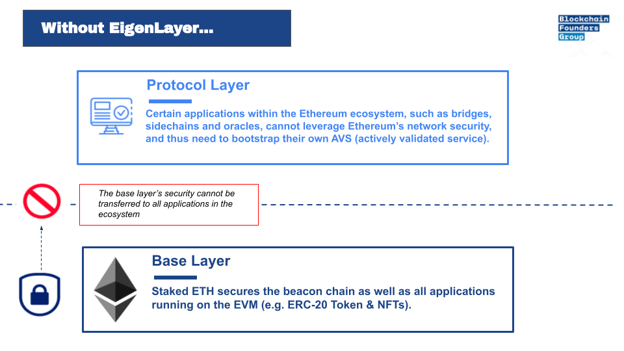

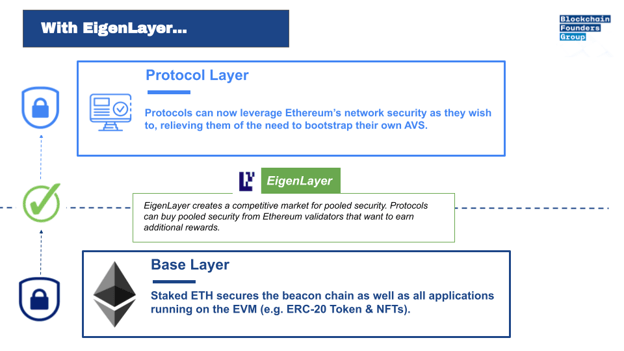

Ethereum’s transition to a PoS consensus mechanism, while also highly beneficial from an ecological perspective, has created the foundation for a new market revolving around restaked ETH. I am referring to EigenLayer, which recently raised another $50 million, and their striving to build a “marketplace for decentralized trust”, as founder Sreeram Kannan himself puts it. In a nutshell, the idea is for Etereum validators to restake their ETH for other use cases, thereby securing other networks and reducing the cost of bootstrapping new blockchain applications6. This is supposed to relieve emerging blockchain projects from the hassle of creating their own consensus and security mechanism, instead leveraging Etheruem’s sophisticated security, effectively offering a novice way of Security-as-a-service (SaaS).

DeFi analyst “The DeFi investor” sums it up like this:

“In short, Eigenlayer is building a marketplace where ETH node operators can opt to provide services for additional fees. They will even be able to validate networks such as side chains or even non-EVM networks.”

Projects like oracles, sidechains, or blockchain bridges that rely on data outside of Ethereum could benefit from this trend, as more staking collateral inherently means higher network security, raising the costs of funds to infiltrate a network.

Figures 5 & 6: Simplified breakdown of the benefits EigenLayer provides to certain protocols in the Ethereum ecosystem.

Wrapping up

This article was supposed to shed some light on topics touched on in a16z’s latest “State of Crypto” report, providing further insights. We can note that while crypto flagships Bitcoin and Ethereum while indeed the most secure, decentralized, and robust crypto networks, still have certain centralization attacking vectors that need to be worked on in the coming years to fully embody the ethos of Web3 as it was meant to be. Furthermore, projects like Celestia, striving to advance the modular blockchain framework, and EigenLayer, effectively providing a disruptive Etherem SaaS solution, help push the frontiers of Web3 by improving interoperability, ease of use, and incentives to join and build in the cryptoverse. Find a16z’s report here.

References

- https://ethernodes.org/networkType/Hosting

- https://twitter.com/MessariCrypto/status/1560068983390318594

- https://www.bankless.com/will-rollups-decentralize

- https://celestia.org/what-is-celestia/

- https://medium.com/momentum6/modular-blockchains-the-next-alpha-celestia-overview-456ca5bbf9b1

- https://consensys.net/blog/cryptoeconomic-research/eigenlayer-a-restaking-primitive/

- https://api.a16zcrypto.com/wp-content/uploads/2023/04/State-of-Crypto.pdf

About Blockchain Founders Group

Blockchain Founders Group (BFG) is the driving force behind web3 innovation. As a company builder, we bring together a team of blockchain visionaries, experienced entrepreneurs, and industry experts, all committed to nurturing emerging talent. Our BFG acceleration programs serve as your springboard for launching blockchain startups, transforming concepts into reality in just 2-3 months. Each cohort develops 5-8 unique web3 ideas, and selected projects will be financially supported with 70,000 - 100,000 EUR, along with access to our extensive network. Join us in shaping the future of web3!

Stay updated by connecting with us on LinkedIn, Medium, Twitter, and YouTube.

Contact: Max Zheng, Head of Corporate Development & BFG Superstars Program, max.zheng@blockchain-founders.io

Subscribe by email

Share this

You May Also Like

These Related Stories

The Predominant Web3 Business Models And Their Key Metrics

Web3 Business Models - Crypto Payment Services and Financial Inclusion

No Comments Yet

Let us know what you think